Boq term deposit calculator

Need to check out estimated returns on ME term deposits? Terms and conditions apply.

Have peace of mind knowing ME's award winning term deposits work harder for your nest egg. No set-up fees, no account-keeping fees. With ME, your term deposit is your cash, and it stays that way. Your term deposit savings are protected by the Australian Government's deposit guarantee. See how your savings can grow with competitive term deposit rates, zero bank fees and our fixed term deposits. Compare our best term deposit rates to see which term is right for you. Looking for business rates?

Boq term deposit calculator

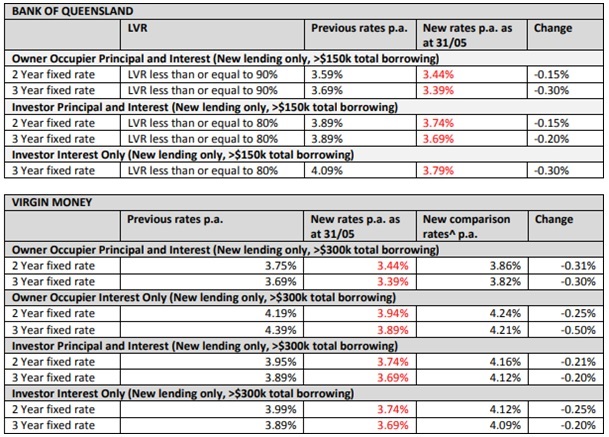

The Bank of Queensland Term Deposit has rates on offer for terms from 1 month through to 4 years. It has no account maintenance or transaction fees so you can lock your money away knowing that all the interest you earn is yours to keep or reinvest and it is not being eaten away fees. The Bank of Queensland Term Deposit comes with a wide range of terms to choose from starting from 28 days and up to 4 years. BOQ's top term deposit rate is 4. Interest is calculated daily and paid at the end of your investment term or annually if you have a term longer than 12 months. You can also choose to have it paid either into your Bank of Queensland account, or into an account with another bank. The Term Deposit has an automatic rollover, which means that you really need to make sure you keep a close watch on that rollover date otherwise you could find you've been locked into a new fixed term with a less competitive rate than what's on offer out in the market. Different interest rates apply to different amounts or different interest payment frequencies. Tried 8 banks and credit providers and by far the best was BOQ. The money we invested with them was.

Different interest rates apply to different investment amounts, terms and interest payment frequencies. Home loan banking package Basic home loan Home buyers guide. We're here to help.

If you are deciding on opening a new savings or term deposit account, you need to know the current interest rates. Below is the complete list of the current, competitive interest rates for our AUD savings accounts, everyday banking, business banking and term deposit accounts. Foreign currency deposit rates are available upon request. Enquire now. Bank with peace of mind. Learn more. Any information is of a general nature only.

Looking for a term deposit from BOQ? Review interest rates, terms and more with InfoChoice. However, as per the BOQ website, customers who want to make a larger deposit can contact BOQ directly and make arrangements. After three months though, he decides to withdraw the entire sum, giving 31 days' notice prior. The current rate for three month term deposits is 2.

Boq term deposit calculator

We are experiencing a delay to some transactions in and out of BOQ accounts. Type a minimum of three characters then press UP or DOWN on the keyboard to navigate the autocompleted search results. To apply over the phone, call us on 55 72

Ashtyn sommer nudes

Switching to myBOQ. Switching to BOQ. They provide all the services we need and at generally competitive price. Personal Finance. Bank of Queensland Term Deposit. Business Knowledge Hub. ME Accordian How do I know when my term deposit is going to mature? Remediation Funds Owed. Our high interest term deposit account gives you the flexibility to choose your term and to choose when and how you receive your interest payments. Bank with peace of mind. Compare our best term deposit rates to see which term is right for you. Their customer service is always great. You can easily change the sort order of the products displayed on the page.

Fact checked. It now has branches throughout Australia offering full-service retail and business banking products.

Savings accounts. Interest rates have always been up front and competitive with the big banks in our area. Log On Super child pages. BOQ Kitchen. If we can verify you online, your term deposit will be open as soon as the funds are received — usually within two business days. Repay all of your term deposit by transferring funds to your nominated account. We reserve the right to cease offering these products at any time without notice. Our high interest term deposit account gives you the flexibility to choose your term and to choose when and how you receive your interest payments. Payment options Under 12 months: Monthly or at maturity. Personal Personal child pages. From putting money into your term deposit to changing your term deposit maturity instructions, get the lowdown on term deposits with ME. The issuer of these products and services is BOQ Specialist.

It exclusively your opinion