Bme: enc

However, bme: enc, what if the stock is still a bargain? If you like the stock, you may want to keep an eye out for a potential price decline in the future.

About the company. It offers bleached eucalyptus kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste. Trading at Earnings grew by Trading at good value compared to peers and industry.

Bme: enc

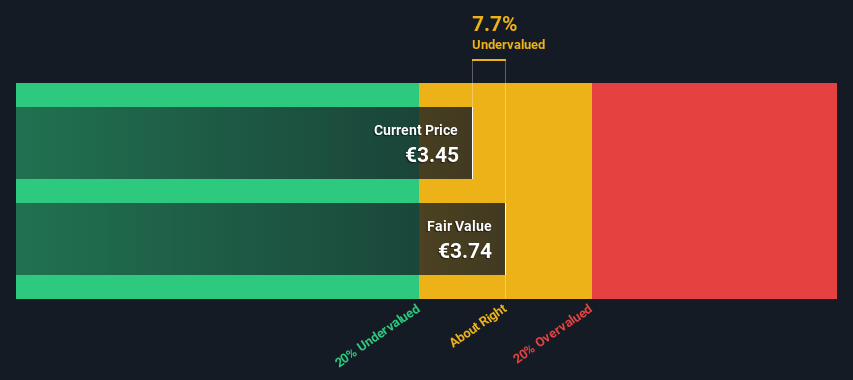

While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? Assessing first and foremost the financial health is essential, as mismanagement of capital can lead to bankruptcies, which occur at a higher rate for small-caps. I believe these basic checks tell most of the story you need to know. This ratio can also be interpreted as a measure of efficiency as an alternative to return on assets. For Forestry companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment. With a debt-to-equity ratio of This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. Ideally, earnings before interest and tax EBIT should cover net interest by at least three times. For ENC, the ratio of 7. Valuation : What is ENC worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ENC is currently mispriced by the market. Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Discover growth companies.

EPS is expected to decline by 8. Earnings growth rate. Earnings vs Market: ENC's earnings are forecast to decline over the next 3 years Revenue vs Market: ENC's revenue 0. View Valuation.

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. ENC chart. Key stats. Market capitalization. Dividend yield indicated. Price to earnings Ratio TTM.

Bme: enc

BME abbr. Bachelor of Mechanical Engineering. All rights reserved. Copyright , , by Random House, Inc.

Millennium downtown new york hotel

First quarter earnings: EPS misses analyst expectations Apr Silver Highs and lows. Dividend of See more updates Recent updates. Nov View Valuation. Valuation : What is ENC worth today? Earnings per Share Growth Forecasts. Is the stock undervalued, even when its growth outlook is factored into its intrinsic value?

We use them to give you the best experience. If you continue using our website, we'll assume that you are happy to receive all cookies on this website.

Dividends Price target decreased by 7. Highs and lows. Dividend of Discover growth companies. Add to a list Add to a list. The Company operates pulp mills and power generation plants in Spain. MarketScreener is also available in this country: United States. Mosquera Lopez-Leyton td:not. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste.

0 thoughts on “Bme: enc”