Blue chip stocks asx

A blue-chip share is a company that's considered the best of the best, like a casino's most expensive blue chips. Blue chip stocks asx chips represent financial stability, long-term growth, a strong track record, and even prestige. In fact, all the positive characteristics of being among the market's top companies for some time.

Blue chip shares are the stocks of well-established companies with a long history of performance and stability. These companies tend to have dependable business models and strong credit ratings. Blue chips companies tend to be market leaders, and blue chips themselves are typically the largest companies in their respective stock market sectors. The term "blue to buy the blue chips or buy blue chip shares" is derived from poker, where the blue chips are the highest valued ones. In the Australian Securities Exchange ASX , an exchange-traded fund many of many blue chip companies , stocks and companies are household names. Because these companies have large market capitalizations, and high trading volumes, liquidity is not an issue.

Blue chip stocks asx

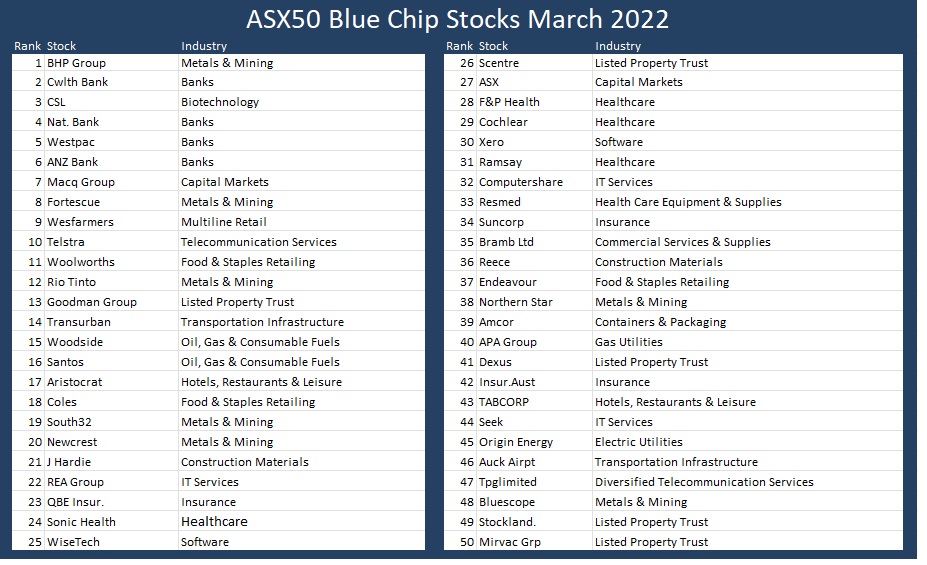

This article highlights 5 blue chip stocks in the Australian stock market in , focusing on their stock code, index percentage, market cap, and revenue etc. These 5 blue chip stocks are part of the ASX index , which represents the largest companies listed on the Australian Securities Exchange. The performance of blue chip stocks in Australia over the last decade has been mixed. Blue chip stocks are shares of large, stable companies that have a proven track record of consistent earnings and growth. These companies are typically leaders in their respective industries and have a strong brand presence. The term "blue chip" refers to the highest-value poker chips in the game, which were traditionally colored blue. Click to check guideline: How to invest stocks in Australia. Its mining activities are divided into three segments, namely Copper, Iron Ore, and Coal. The company is engaged in extracting copper, silver, zinc, molybdenum, uranium, gold, iron ore, metallurgical coal, and energy coal. It is also involved in nickel mining, smelting, and refining and potash development activities. It was founded in and has its headquarters in Melbourne, Australia.

The bank has an outstanding CET1 ratio of The company provides various types of accounts, including savings, term deposits, business transactions, not-for-profit transactions, foreign currency, blue chip stocks asx, farm management deposits, project and retention trusts, and statutory trust accounts.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. If you're building a portfolio, then having a few blue chips in there could be a good starting point. Blue chips are typically large companies that have been operating for many years, have stable cash flows, experienced management teams, and positive outlooks. These qualities can make them a good foundation to build a portfolio from.

Blue chip stocks asx

A blue-chip share is a company that's considered the best of the best, like a casino's most expensive blue chips. Blue chips represent financial stability, long-term growth, a strong track record, and even prestige. In fact, all the positive characteristics of being among the market's top companies for some time. There are no hard and fast rules about what makes a blue chip blue. Here are some of the characteristics of blue chips, how they perform, and how you can invest in them. They are the market's biggest and brightest equities — the companies investors hold in the highest regard. Blue chips have usually demonstrated the following traits over many years:. These are some of the typical characteristics of blue chips.

Mega hack

Nonetheless, this has some drawbacks. For Australians keen to dip their toes into the waters of stock investing or seasoned traders looking to park some capital in a safer harbour, blue chip stocks offer a blend of stability and modest performance, along with the potential for passive income from dividends. As of 8 August , the following are the top 10 blue-chip stocks on the ASX, ranked by market capitalisation:. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. ETFs can provide exposure to multiple blue chip stocks in a single transaction, providing a cost-effective way to access the Australian, mostly blue chip stock and share market. Investing in blue chips is a great way for beginner investors to dive into the stock market. Blue chips are typically large companies that have been operating for many years, have stable cash flows, experienced management teams, and positive outlooks. Many larger banks offer online brokerage services attached directly to your existing bank account. To calculate it, simply multiply the company's share price by the number of shares on issue. The market was unstable but the CSL shares remained strong and after hitting their lowest week point in September, they have managed to show some substantial gains. We make every effort to provide accurate and up-to-date information. Several blue chip companies also pay dividends. These companies tend to have dependable business models and strong credit ratings. September 25,

Investing in blue chip shares can be a great way to build a stable and diversified portfolio. Get to know 10 of the top ASX blue chip companies. A blue chip stock is a stock of a well-established and financially stable company with a history of consistent growth and a strong track record of performance.

Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. View more. They tend to believe that when investing in a stock that is perceived to be undervalued, they are more likely to make a potential profit. However you choose to invest, it's important to develop a strategy, stay the course, and stay Foolish. The term "blue chip" refers to the highest-value poker chips in the game, which were traditionally colored blue. In the Australian Securities Exchange ASX , an exchange-traded fund many of many blue chip companies , stocks and companies are household names. Blue chips are typically large companies that have been operating for many years, have stable cash flows, experienced management teams, and positive outlooks. Goodman has been growing at a solid rate over the last decade thanks to the success of its strategy of developing high-quality industrial properties in strategic locations. In terms of diversification into exploration and production, operationally efficient BHP is in a better position to withstand any market volatility. This diversification means BHP is not dependent on a single commodity's price to generate revenue.

Yes, really. All above told the truth. Let's discuss this question.