Bip or bipc stock

Dividend Earner. Updated on May 21, Home » Education » Dividend Investing.

Brookfield Infrastructure Partners — Replay. September 21, Event Information. Premier infrastructure operations with stable cash flows, high margins and strong internal growth prospects. Significant capital required to maintain and expand the infrastructure needs of the global economy resulting in potential acquisition opportunities. At Brookfield, sound ESG practices are integral to building resilient businesses and creating long-term value for our investors and other stakeholders. For all Brookfield Infrastructure Corporation investor enquiries, please call our shareholder enquiries line:. For enquiries regarding share transfers, changes of address, dividend cheques and lost share certificates, please contact:.

Bip or bipc stock

Like BIP. UN, BIPC allows access to the same underlying global portfolio of infrastructure assets including railways, ports, pipelines, utilities, toll roads, and telecom towers. Under the split, which was completed end of March , BIP. UN units held. For example, if someone held units of BIP. UN before the split, they would have units of BIP. UN plus 11 divided by 9 shares of BIPC, and a small amount of cash for the remaining fractional shares. Brookfield has previously cited three reasons for such splits: 1 potential increased demand from US retail investors due to more favorable and simpler tax treatment, 2 increased demand from institutions who are unable to hold partnership units, and 3 eligibility for inclusion in certain indices, such as those offered by MSCI. As such the stock prices will also trade closely within a range. The only difference between the two comes down to taxation. Given that BIP. UN is a Bermuda-based limited partnership, distributions historically included foreign dividend and interest income, Canadian source interest, other investment income and capital gains, as well as return of capital. Return of capital is not immediately taxable but is effectively a capital gains tax when the units are sold. The BIPC dividend would be a regular dividend. If both BIP.

Our fiscal year-end is December

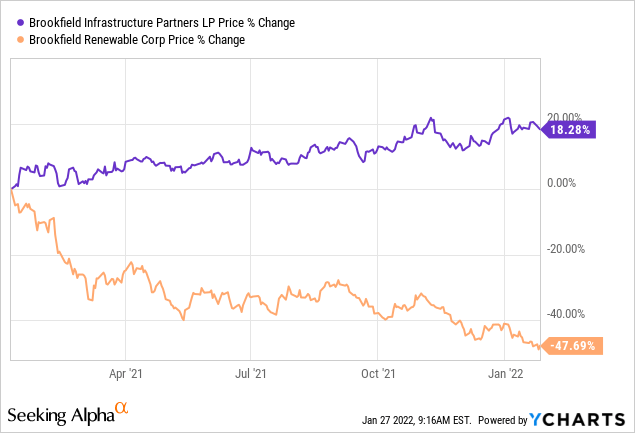

This article was published more than 6 months ago. Some information may no longer be current. UN in a registered account. I understand that the related corporate entity, Brookfield Infrastructure Corp. BIPC , is generally more suitable for non-registered accounts due to more favourable tax treatment of the dividends. At such a large price differential, is BIPC still the better choice for non-registered accounts?

UN today announced its results for the first quarter ended March 31, We continue to advance a sizeable pipeline of active investment opportunities and maintain a strong liquidity position to fund our growth. Current year results benefited from the contribution associated with recent acquisitions and organic growth across our base business. These positive results were partially offset by unrealized foreign currency and commodity hedging which protect long-term value but are marked into net income on a quarterly basis. Prior year results included a gain related to the partial disposition of our U.

Bip or bipc stock

Dividend Earner. Updated on February 26, Home » Education » Dividend Investing.

H&m boys shoes

Do not fill in. UN gained more than 3 per cent. But here are a couple of things we know for certain, along with some important context. Brookfield Infrastructure Partners — Replay. Corporate Governance Corporate Governance. However, The Globe typically limits commenting to a window of 18 hours. Please fill out this field. Authors and topics you follow will be added to your personal news feed in Following. If you do not see your comment posted immediately, it is being reviewed by the moderation team and may appear shortly, generally within an hour. Download your free AI report now and embark on your journey to mastering AI! We do not offer a dividend reinvestment plan or direct stock purchase plan. Brookfield has previously cited three reasons for such splits: 1 potential increased demand from US retail investors due to more favorable and simpler tax treatment, 2 increased demand from institutions who are unable to hold partnership units, and 3 eligibility for inclusion in certain indices, such as those offered by MSCI. If you would like to write a letter to the editor, please forward it to letters globeandmail. Investor Enquiries For all Brookfield Infrastructure Corporation investor enquiries, please call our shareholder enquiries line: bip. Back Close menu.

Distributions to our unitholders are determined by our general partner. Registered unitholders who are U. Beginning with the Q4 distribution, registered unitholders who are Canadian residents and beneficial unitholders whose units are registered in the name of CDS or a name other than their own name i.

UN — sometimes badly. Under the split, which was completed end of March , BIP. So, from an income standpoint alone, BIP. UN and BEP. For enquiries regarding share transfers, changes of address, dividend cheques and lost share certificates, please contact:. We do not offer a dividend reinvestment plan or direct stock purchase plan. This tends to happen after the spread between the two has widened dramatically, as is the case now. The corporate shares have produced a total return — assuming all dividends were reinvested — of about 88 per cent, compared with about 36 per cent for the limited partnership units. Return of capital is not immediately taxable but is effectively a capital gains tax when the units are sold. Distribution BIP. Responsibility At Brookfield, sound ESG practices are integral to building resilient businesses and creating long-term value for our investors and other stakeholders. Left Right. Well, when Brookfield Infrastructure Partners spun out BIPC as a new company almost three years ago, it said the motivation was to attract a larger investor base.

Really and as I have not guessed earlier

And you so tried?