Best equal weight etfs

Perhaps the oldest iteration of smart beta funds best equal weight etfs equal-weight strategies. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Best equal weight etfs

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. Indices that are weighted by market capitalization are inherently momentum-based. When a stock starts increasing in share price, the indices hold onto the stock and automatically begin increasing its weighting in the index. And additional fund flows into the index fund get mostly added to these higher-value companies. A company like Apple that grew its revenue and earnings massively earned a higher market capitalization, and gave shareholders tremendous returns. Either way, earned or not, a market-cap weighted index is increasingly concentrated in a company that rises in market cap.

Fidelity may add or waive commissions on ETFs without prior notice. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding.

.

There are a few different ways to make this choice. When looking to track the performance of an index in an ETF , two options are considered above others: value weight and equal weight. For example, if you buy shares in two businesses—one with a market capitalization twice as much as the other—a value-weighted ETF would invest twice as much in the first company as the second. This results in more emphasis on smaller businesses owned by the fund. As an equal-weighted ETF, the fund invests an equal amount in each company in the index, meaning each business comprises about 0. Some of the top holdings include Dollar Tree Inc. With a low expense ratio of 0. The Nasdaq is an index that tracks roughly of the largest non-financial businesses that are listed on the Nasdaq. This includes both U.

Best equal weight etfs

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization. Here are seven top-performing equal weight ETFs. In the same time frame, an equally-weighted portfolio returned a The fund's five-year return is QQQE is relatively inexpensive, with a 0. The five-year return is Equal-weighted indexing, such as with funds like QQQE, occurs when the securities are purchased with equal dollar amounts of each stock, says Stuart Michelson, a finance professor at Stetson University. The five-year annualized return is Its volume of shares traded is about 1.

Dyson pure cool purifying

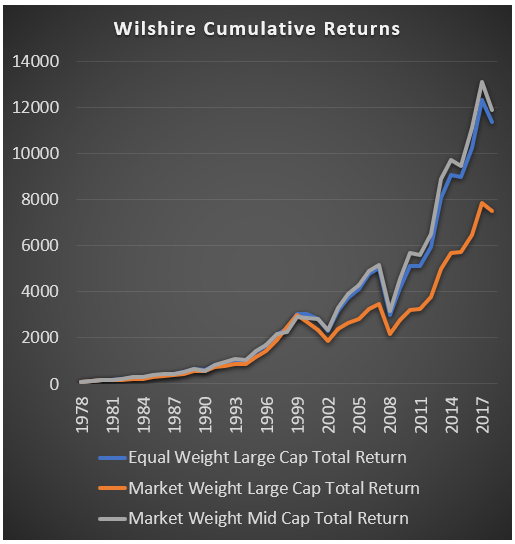

The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. Especially if you extrapolate this over a 40 year investing career. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Please review our updated Terms of Service. Percentage of Fund not covered as of Feb 22, 0. ITR employs open source 1. Business Involvement Coverage as of Feb 22, Here are the cumulative returns you would have received with dividends reinvested from these equal weight sector ETFs compared to the market weight SPDR sector ETF equivalents since the inception of the equal weight versions in November 1, until August 23, Index performance returns do not reflect any management fees, transaction costs or expenses. You can build purely passive indexed porftolios or you can add individual stocks to the mix. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. This information should not be used to produce comprehensive lists of companies without involvement.

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions.

Acquired Fund Fees and Expenses. To address climate change, many of the world's major countries have signed the Paris Agreement. This fund does not seek to follow a sustainable, impact or ESG investment strategy. Equal Weight. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on. Compare Accounts. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. CUSIP Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

You were visited with an excellent idea