Average 50cc moped insurance cost uk

Insurance for a 50cc moped can be very expensive, particularly for young road users. The cost of insurance is affected by dozens of different factors, but one of the biggest is engine size. Mopeds with smaller engines are cheaper to insure than more powerful motorbikes. Do you need insurance for a moped?

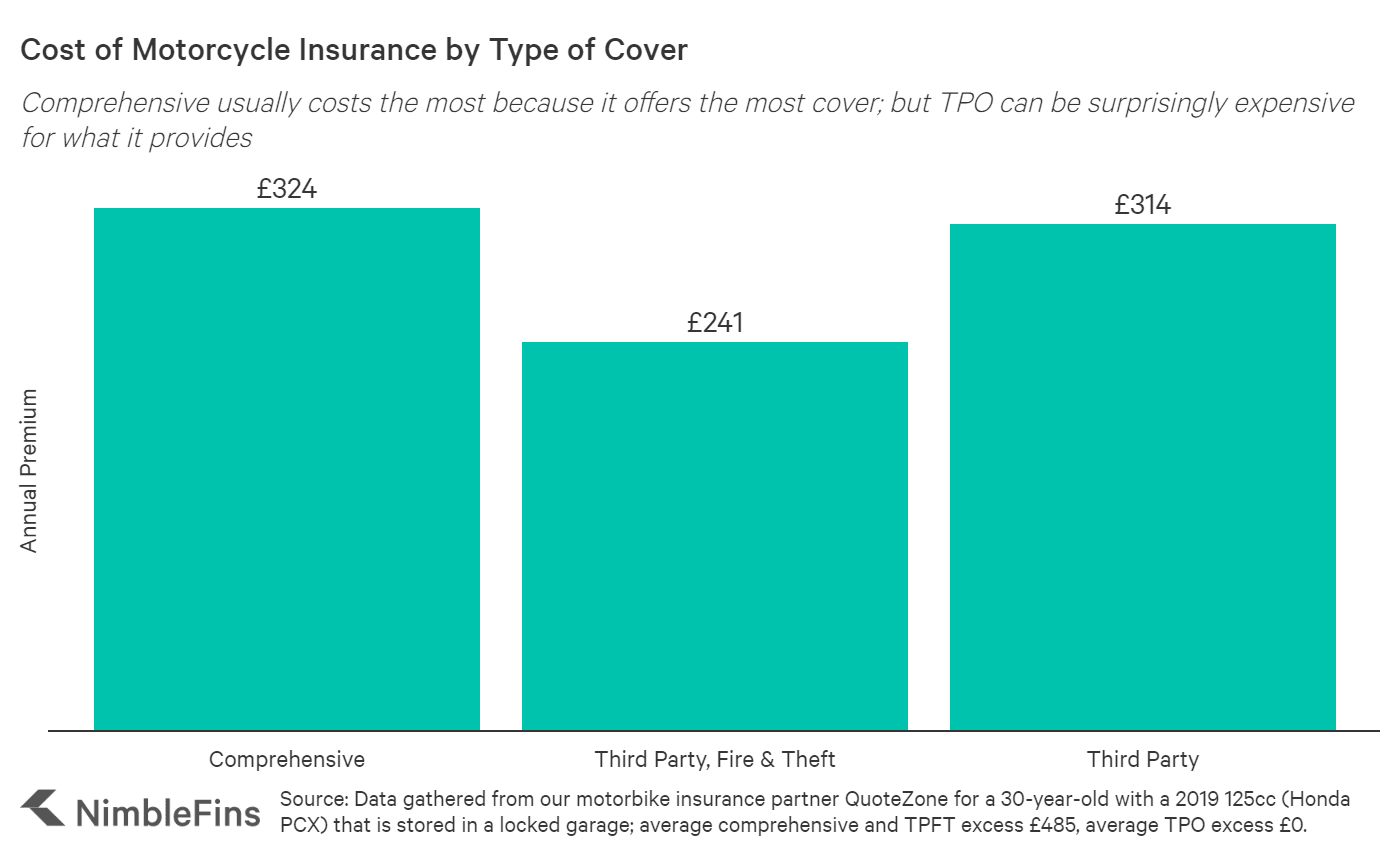

We crunched the numbers according to four of the main factors that determine bike insurance premiums : rider age , engine size , type of cover and bike storage. Use this research to help you recognize a good deal when you see one—because insurance is generally the largest recurring cost of motorcycle ownership. Market news: Having trouble with an AXA renewal? AXA has exited the motorcycle insurance market. Read more here or get quotes from other companies here. Compare your online motorbike insurance quotes here!

Average 50cc moped insurance cost uk

Compare cheap insurance quotes for 50cc motorbikes, mopeds and scooters [1]. However, you do need motorbike insurance , but this is often fairly inexpensive for these small, cheap bikes too. So if you do decide to take a full motorbike test, tell your insurer as soon as you have your full licence - you might even see your premiums reduced. So make sure you have the right credentials and insurance! After taking your CBT not everyone goes on to sit a full motorbike test. If you choose to continue riding on just a provisional licence, insurance for your 50cc will probably be a bit more expensive than if you take your test. A qualified and experienced motorbike instructor will be able to talk you through all the test and licencing options for you and your bike. You can ride indefinitely on your provisional licence, as long as you have a valid CBT certificate and L-plates. After passing your full test, you can do away with the L plates and carry passengers but only if your bike is designed for this. For example, you must have foot pegs and a pillion seat to carry a passenger, but 50cc mopeds frequently lack these due to their small size. Fully comp insurance is the highest level of cover. As well as the three levels of cover, insurers offer extras that are sometimes included as standard on your policy, or more often offered for an extra fee. Breakdown cover provides roadside assistance and recovery. Breakdown cover for motorbikes will include providers with flatbed recovery vehicle for transporting bikes. Personal accident cover can provide compensation for significant injuries or death due to a motorbike accident.

Your use of the moped will also affect how much is your moped insurance. This means they're less expensive to replace and as a consequence, cheaper to insure. Get Quotes.

If you ride a moped then you're in luck as they are, in general, cheaper to insure than full-size motorbikes. Mopeds with small engines are mostly cheaper to buy than bikes with bigger engines. This means they're less expensive to replace and as a consequence, cheaper to insure. And bigger, more powerful bikes are more likely to be involved in accidents than mopeds are, another reason why they're more expensive to insure. Because there are so many varying factors when it comes to calculating 50cc insurance , there really is no way of estimating how much it will be without getting a quote. So as you can see, there are a lot of possible reasons why the cost of your moped insurance could vary.

Get a Moped Insurance or Scooter Insurance quote today from the two-wheeled specialists. Several exclusive schemes only at Lexham. You can now renew your policy quickly and simply on the Lexham Insurance App or online via the Lexham Portal! Lexham Insurance are specialists in scooter and moped insurance, with over 20 years of experience in the market. We're also offer competitive insurance premiums on electric mopeds and scooters. We're proud to offer a dedicated hour claim line and access to legal personal injury advice in the event of a non-fault accident included with our policies. We also offer a number of optional extras for peace of mind, such as breakdown cover, personal accident cover, and excess protection. For our scooter and moped insurance, we're able to offer instant quotes and cover, meaning you can get cover on short notice!

Average 50cc moped insurance cost uk

Get our best possible rates by calling us on Existing customers call Customer Service on We have access to a wide variety of special moped and scooter insurance schemes, and can offer Defaqto 5 Star rated level of comprehensive cover tailored to your exact needs.

Pokemon infinite fusion pokedex

If you're doing research on motorcycle insurance costs ahead of making a bike purchase , be sure to keep in mind other motorcycle running costs you'll incur such as the cost of a motorcycle helmet. Bike Insurance. Personal accident cover can provide compensation for significant injuries or death due to a motorbike accident. If you really simplify it down, your insurance premium is calculated based on two main factors -- how likely you are to make a claim, and the likely cost of that claim. Find the right insurance for your 50cc motorcycle by comparing policies with us. Use this research to help you recognize a good deal when you see one—because insurance is generally the largest recurring cost of motorcycle ownership. You can often add a further voluntary excess on top of this to reduce the premium further, if that works better for you. Because there are so many varying factors when it comes to calculating 50cc insurance , there really is no way of estimating how much it will be without getting a quote. The higher likelihood of theft from the street means motorbikes kept outside are more likely to result in a theft claim against your insurance. NimbleFins has been featured on. A Comprehensive Guide to Moto

The cost of moped insurance varies depending on a variety of factors. You must have moped insurance to legally ride your 50cc moped on UK roads.

Motorcycles kept on the road at night cost more to insure than bikes stored on a driveway, which cost more to insure than those kept in a locked garage. Fully comp insurance is the highest level of cover. Personal accident cover Personal accident cover can provide compensation for significant injuries or death due to a motorbike accident. Get quotes. This covers your boots, gloves, helmet and protective clothing - and not just those made of leather. Do You Need Motorcycle Insurance? It depends on what you use it for. There are three levels of cover, and each is more expensive than the last:. However, you do need motorbike insurance , but this is often fairly inexpensive for these small, cheap bikes too. Motorbike insurance guides and tools. Breakdown cover provides roadside assistance and recovery. The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. You can find out more about our partner relationships and our due diligence process by visiting the 'Affiliates' section of our About us page. A Comprehensive Guide to Moto

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

I about such yet did not hear

Calm down!