At&t stock price dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. T stock.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

At&t stock price dividend

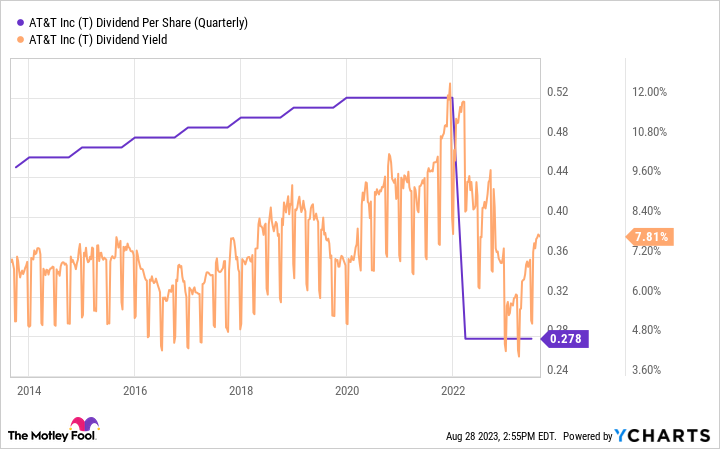

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. T pays dividends on a quarterly basis. T has increased its dividends for 1 year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. T dividend payments per share are an average of 0. Add T to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. T shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

Best High Dividend Stocks.

.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. T stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal. Monthly Income Goal. Regular payouts for T are paid quarterly.

At&t stock price dividend

There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1. It has an excellent track record of paying increased dividends to shareholders and this is forecast to continue. Latest Dividends. Previous Payment. Next Payment. Sign Up Required.

R childfree

Returns Potential. Nov 01, This Year's Ex-Dates. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Dividend Fwd. Best Dividend Capture Stocks. You take care of your investments. Dividend Yield Calculator. Sam Bourgi Apr 19, Make informed decisions based on Top Analysts' activity. Sector: Communication Services Sector Average: 2. Best Consumer Staples.

Congratulations on personalizing your experience. Email is verified. Thank you!

This is the total amount of dividends paid out to shareholders in a year. Top Online Brokers. My Portfolio. Nov 01, Sector: Communications. Allocation Funds. Dividend Challengers yrs. Dividend Dates. New World Brands Inc. How to Manage My Money. Get actionable alerts from top Wall Street Analysts. Industry: Telecommunication. Best Dividend Stocks.

0 thoughts on “At&t stock price dividend”