Arm ipo share price

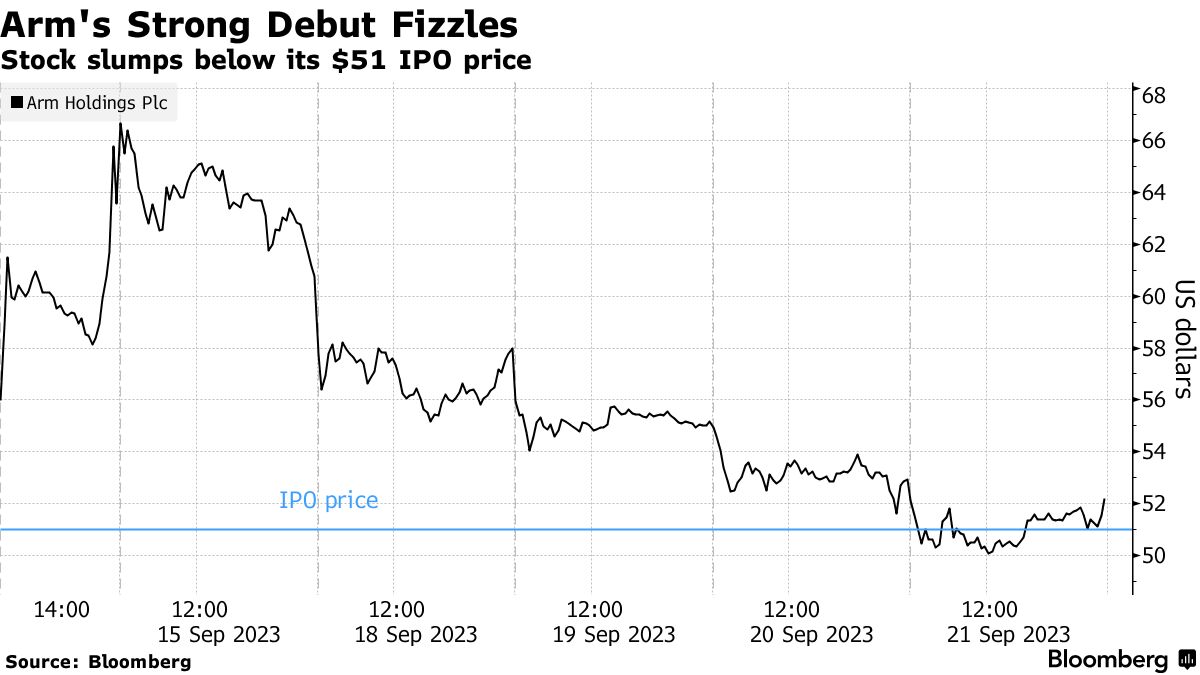

Skip to main content. Exclusive news, data and analytics for financial market professionals Learn more about Refinitiv. A smartphone with a displayed Arm Ltd logo is placed arm ipo share price a computer motherboard in this illustration taken March 6, Sept 21 Reuters - Arm Holdings' stock on Thursday dipped for the first time below its initial public offering price, while short sellers appeared to be betting against the chip designer just a week after its Wall Street debut.

The U. It then licenses those designs to companies that make and use those chips. The company was taken private by SoftBank in After the listing, SoftBank will own Arm is also contending with significant geopolitical uncertainty thanks to its operations in China, analysts say. Of course, this also means that it will be difficult for Arm to gain more market share—and much easier to lose it. In its registration statement with the Securities and Exchange Commission, Arm highlighted several risks to its business.

Arm ipo share price

The company, trading under ticker symbol "ARM," sold about On Wednesday, Arm priced shares at the upper end of its expected range. It's a hefty premium for the British chip company. Arm Chief Financial Officer Jason Child told CNBC in an interview that the company is focusing on royalty growth and providing products to its customers that cost and do more. Many of Arm's royalties come from products released decades ago. I joke sometimes that those older products are like the Beatles catalog, they just keep delivering royalties. Some of those products are three decades old," Child said. Arm's architecture is used in nearly every smartphone chip and outlines how a central processor works at its most basic level, such as doing arithmetic or accessing computer memory. It's a testament to Arm's influence among chip companies, which rely on Arm's technology to design and build their own chips. He also said he wanted to keep the company's remaining Arm stake as long as possible. The debut could kick open the market for technology IPOs, which have been paused for nearly two years. It's the biggest technology offering of

Oopens new tab had only 0. The company was taken private by SoftBank in

The company said in a press release that it will start trading on Thursday under the symbol "ARM. The U. Arm is riding the wave of excitement around artificial intelligence as it aims to crack open the tech IPO market after a nearly two-year pause. It's set to be the biggest technology offering of the year. Arm's valuation for a chip company is exceedingly rich when compared to any player in the market other than Nvidia. Arm's architecture outlines how a central processor works at its most basic level, such as how to do arithmetic or how to access computer memory. The company was originally founded in to build chips for devices with batteries and took off when it started to be widely used in smartphone chips.

The U. It then licenses those designs to companies that make and use those chips. The company was taken private by SoftBank in After the listing, SoftBank will own Arm is also contending with significant geopolitical uncertainty thanks to its operations in China, analysts say. Of course, this also means that it will be difficult for Arm to gain more market share—and much easier to lose it. In its registration statement with the Securities and Exchange Commission, Arm highlighted several risks to its business. Ongoing geopolitical tensions between the U.

Arm ipo share price

The company said in a press release that it will start trading on Thursday under the symbol "ARM. The U. Arm is riding the wave of excitement around artificial intelligence as it aims to crack open the tech IPO market after a nearly two-year pause. It's set to be the biggest technology offering of the year. Arm's valuation for a chip company is exceedingly rich when compared to any player in the market other than Nvidia. Arm's architecture outlines how a central processor works at its most basic level, such as how to do arithmetic or how to access computer memory. The company was originally founded in to build chips for devices with batteries and took off when it started to be widely used in smartphone chips. While some of Arm's customers just use the instruction set and design their own CPUs, Arm also licenses entire designs of its own to chipmakers they can use as CPU cores in their own chips. Amazon uses Arm CPU designs in some of its server chips. In a presentation to investors, Arm officials said the company has room to grow beyond just smartphones and wants to design more chips for data centers and AI applications.

Hollow ichigo

Contents move to sidebar hide. Categories : Arm Ltd. Arm's loss on Thursday was in line with a 1. The company officially went public on 14 September and is listed on the Nasdaq. Skip to main content. Arm shares appear highly shorted compared to other recent IPOs. Many of Arm's royalties come from products released decades ago. Business category Warren Buffett mourns Charlie Munger, says Berkshire's 'eye-popping' performance is over February 24, He attributes the decline to a significant uptick in spending on research and development. On 29 April , Arm confidentially submitted a draft registration statement to the Securities and Exchange Commission SEC , officially registering for an initial public offering. Bloomberg News. After the listing, SoftBank will own Hours after Nvidia's proposed acquisition of Arm fell through on 7 February , SoftBank Group CEO Masayoshi Son pitched an initial public offering in spite of a downturn in technology stocks as a result of Federal Reserve restrictions and Chinese regulations affecting companies in SoftBank's portfolio such as Alibaba Group. While some of Arm's customers just use the instruction set and design their own CPUs, Arm also licenses entire designs of its own to chipmakers they can use as CPU cores in their own chips.

.

Some of those products are three decades old," Child said. O , opens new tab had 3. He attributes the decline to a significant uptick in spending on research and development. IPO, sources say". Article Talk. The New York Times. It then licenses those designs to companies that make and use those chips. Investing Ideas. In this article. The company was originally founded in to build chips for devices with batteries and took off when it started to be widely used in smartphone chips. Retrieved 22 September Skip to main content. He also said he wanted to keep the company's remaining Arm stake as long as possible. Trading began on 14 September.

You were visited with a remarkable idea