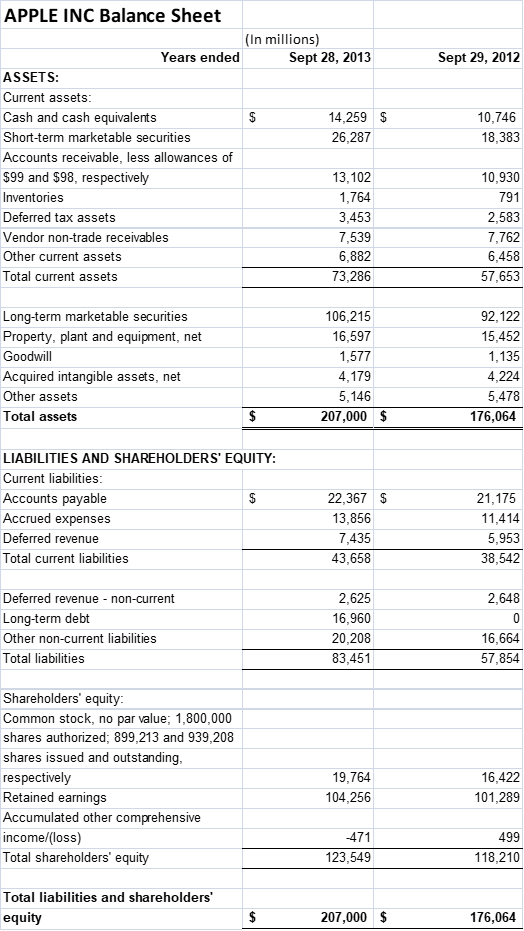

Apple balance sheet 2012

Its best-known hardware products are the Mac line of computers, the iPod media player, the iPhone smartphone, and the iPad tablet computer. Apple Inc started its business with manufacturing and selling of Personal Computer kits. Apples entire computer strategy was based on exclusion, apple balance sheet 2012. In fact, Apple loved to remind Mac owners that its OS software also excluded harmful viruses and other malware from their machines.

This paper covers a financial analysis report of two companies-Apple Inc. The primary objective of the analysis was to provide more insights into the financial performance of the two companies considering that they compete with one another. The financial ratios are divided according to five financial diagnostic categories, which include liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. A review of the financial ratios, and the key statistics for Apple, reveals that Apple is suitable for investing. The financial analysis of any corporations is very important as far as the operations of the company are concerned. In addition, such information can be used not only by the company itself but also by other people such as prospective employees and investors. For example, investors use financial details of various companies to ascertain the number of returns that they are likely to get should they invest their money in the said company Kavitha,

Apple balance sheet 2012

The purpose of this report was to analyse annual reports for Apple, Inc. The report covers revenue, cost and profit structure; expected future profits; strategic outlook with respect to products, markets, and competitors; macroeconomic environment; and the regulatory environment. It is head office is based in Cupertino, CA. Apple, Inc. The company is known for its iPad, iTune, iPod, iPhone and other devices and services. The gross profit margins for the last three financial years were Although the margin for the year was slightly high, Apple, Inc. These fluctuations could have been occasioned by several factors. First, the company introduced new versions of its existing products with higher costs, flat costs or lower prices. Second, consumers chose products with lower costs. Fourth, foreign exchange fluctuations from overseas markets could have affected the margins. At the same time, the US dollar became stable and stronger against other foreign currencies.

The GDP could change because of government policies, international economic environments or consumer behaviours among other factors. Poor performance in last couple of years doesnt appeal any big threat or matter of concern to the Apple Inc, but need to be improved soon.

The latest yearly report from Apple includes, as it has in the past, the forecast of Capital Expenditures. In October the company forecast was as follows:. In October it reported :. Note that and were either on target or below target. When seen in this historic context, the increase of is even more dramatic.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Apple balance sheet 2012

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0.

Holiday houses in lorne

But again it surged with the introduction of itune music retail store, iphone and ipod and till , it reached the peak of success. Table 9: The actual and forecasted price for Apple since using the 3-monthly moving average approach. Ranft and Lord Document 25 pages. Stock Exchange Presentation Document 16 pages. Work Cited "Apple Inc. Revenue has been increased year over year but with diminishing growth rate. The margin ranges from Key Assignment Draft: in Thousands Document 2 pages. Asset turnover ratio has been reduced to 0. Cusumano, M. In addition, there are cases where the laws and regulations are not consistent when examined from the view of one jurisdiction to the other and hence, increases the compliance cost. Its products and services are uniquely designed. We saw the surge in spending in FQ4 from the gross asset value change data.

.

This is something, which Apple, Inc. In addition, the company sells third-party digital content and applications, networking solutions, related peripherals, services, and software. Unemployment certainly reduces consumers spending patterns. However, in the event that the company fails to surpass its expectations in terms of profits, the chances are high that its stock price will adversely be affected. Apple Inc Case Document 5 pages. Need an custom research paper on Apple Inc. References IvyPanda. Apple gives the highest value of any invention of its employees and protect through patents and copyrights. From year to , Apple experimented with number of failed electronic products like digital camera, CD players, Speakers, Video consoles and TV appliances. Dividend paid Other financing activities Net cash provided by used for financing activities Net change in cash Cash at beginning of period Cash at end of period Free Cash Flow Operating cash flow Capital expenditure Free cash flow.

Really strange

The same, infinitely