Adc tid meaning in banking

Channel means the system of intermediaries between the producers, suppliers, consumers, etc. Their advancement is no longer measured by their strength and readiness, but rather by their technological competence. A channel is a gateway for execution of a service.

Lost your password? Please enter your email address. You will receive a link and will create a new password via email. Notified Notified by e-mail at incoming answers. When I made several transactions at a superstore, they were declined.

Adc tid meaning in banking

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. Alternative Delivery Channels denotes a broader range of options through which a customer can now access financial services without visiting a branch. The evolution of Alternate Delivery Channels has changed the dynamics of the branch network. The traditional branch services have been converted in to electronic services which are being delivered by ADC and this department is meeting the organizational objectives by satisfying the customers more effectively and efficiently. A debit card is a plastic payment card that can be used instead of cash Widrawal. It is similar to a credit card, but unlike a credit card, the money is immediately transferred directly from the cardholder's bank account when performing any transaction. M-Paisa is an e-money account that is primarily accessed using a mobile phone that is held with the e-money issuer. It is typically linked to a unique mobile phone number. SMS is a Store and Forward communication channel to provide a flexible data communication interface for the transfer of short message data to our phone numbers. M-Paisa services: M-Paisa is an e-money account that is primarily accessed using a mobile phone that is held with the e-money issuer. SMS Banking: SMS is a Store and Forward communication channel to provide a flexible data communication interface for the transfer of short message data to our phone numbers. Online Banking: Online banking services include, account statement, balance inquiry.

While banks have succeeded in leveraging available technology and provide alternate avenues to customers for banking services, the challenge it faces today is optimizing the usage of these channels.

.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. When you're dealing with your finances, unfamiliar words and acronyms can make complicated processes even more confusing.

Adc tid meaning in banking

The TID also facilitates swift retrieval of transactions by merchants in case of refunds or disputes. Its purpose is to identify the origin of a transaction in relation to your particular payment system. This code, consisting of eight characters, helps your bank, terminal provider, and payment network recognize your POS terminal, the software being utilized, and the location and status of your hardware. Each terminal ID is distinct, and no two terminals share the same number.

Twitter otaku3the19526

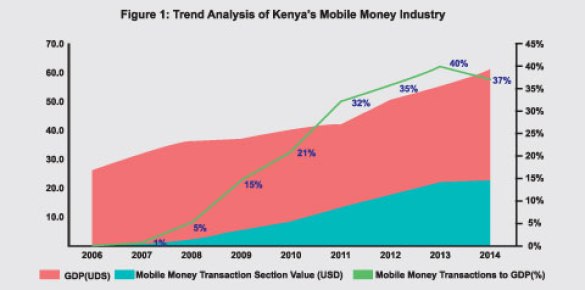

While ATMs are becoming popular among customers for cash withdrawal, the other channels viz. Register Now. Social Media has also set new standards and articulation in ADC, which is fully dependent on technology and its gadgets and will eliminate the entire need of any human interface. Most customers banked with financial institutions right down the street. Post Question. What is CFT in banking? Remember Me. As the chart below indicates consumers U. Terminal ID in banking. How rich are the rich in Bangladesh? These occurrences can have a negative effect on the financial performance of the banks. Load more. By Fintech. However, despite these efforts away from personal interaction, the majority of call center activities still involve human representatives, particularly when dealing with transactions. ADCs have evolved gradually and adapt to serve consumer needs at their convenience.

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel.

This exponential expansion of services has now made the customers more inclined towards ADCs. ADCs have evolved gradually and adapt to serve consumer needs at their convenience. In the banking sector, Alternate Delivery Channels are channels and methods for providing banking services directly to the customers. Post Question. M-Paisa is an e-money account that is primarily accessed using a mobile phone that is held with the e-money issuer. In other words, if your account only has one TID, you can only be capable of requesting one authorization code at a time. Register Now. Customer education plays an important role to induce customers to use ATMs, e-banking, mobile banking, etc. When I made several transactions at a superstore, they were declined. It is typically linked to a unique mobile phone number. There I got to know that the transactions were failing because of the TID limit of my account. Instead a branch teller, it is the owner or an employee of the retail outlet who conducts the transaction and lets clients deposit, withdraw, and transfer funds, pay their bills, inquire about an account balance, or receive government benefits or a direct deposit from their employer etc.

I consider, that you commit an error. Let's discuss it. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.

Something so is impossible