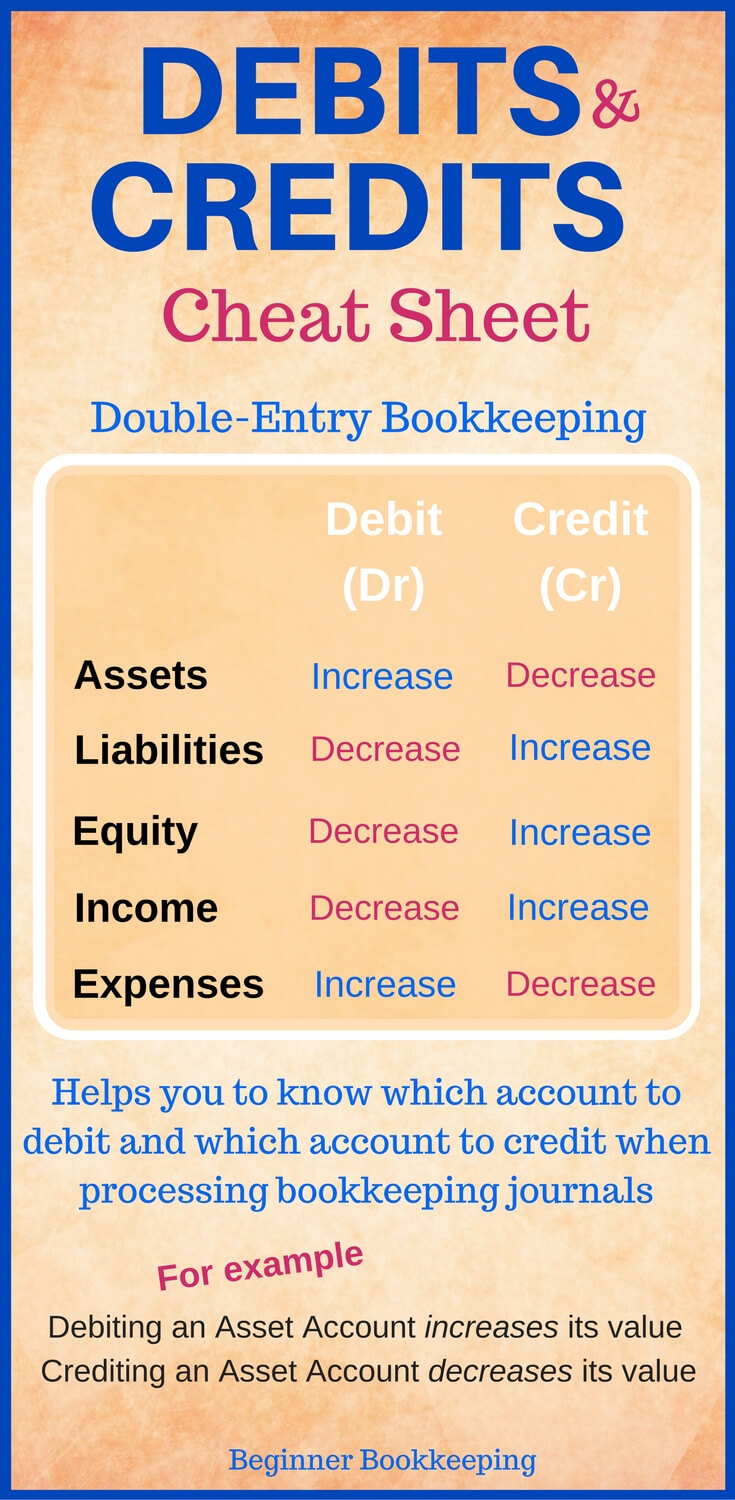

Accounting debits and credits cheat sheet

What Are Debits and Credits in Accounting? Basic Accounting Debits and Credits Examples.

Summary of basic accounting things. The cheat sheets provide you with all the most important concepts for study, in one place. Ranked the 1 iOS accounting app in the US. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Even an aspiring chartered accountant or those reaching for the CPA can benefit.

Accounting debits and credits cheat sheet

Are you confused about all the debits and credits being thrown around? My "cheat sheet" should unscramble the confusion for you. But first you need to know Every accounting transaction you see on your balance sheet and income statement must have at least one debit and one credit. It can be very confusing because while every account can have a debit or credit posted to it, different types of accounts normally have a debit or credit balance. Clear as mud right? He says,. Every time you prepare a transaction, figure out what you received debit and how you paid for it credit. Following the logic above, we now know that assets would normally have a debit balance as they are things we buy or already have like a computer, desk or equipment. Expenses are also debit balances because you received something whether it was phone service, retail space or photocopy paper. Liabilities and equity would normally have a credit balance as this is where the money came from to purchase the things we have. Sales revenue would also have a credit balance because you received cash the debit side of the transaction in exchange for a product or service the where side of the transaction, in this case what you sold to a customer. Where it is easy to get confused when first learning debits and credits is learning the difference between cash and non-cash entries. Many items that hit the income statement sales revenue and expenses do not affect your cash flow.

You pay monthly fees, plus interest, on anything that you borrow.

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts. In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts.

Welcome to the world of accounting, where numbers tell a story and financial health is measured in debits and credits. But fear not! So grab your calculators and get ready to dive into the world of procurement , as we unveil all there is to know about accounting debits and credits — complete with handy tips and tricks along the way. Accounting, the backbone of every business, goes beyond just crunching numbers. Think of accounting as the language of business — it communicates the financial story behind every transaction. At its core, accounting helps businesses keep track of their income and expenses, ensuring accuracy and transparency in financial reporting. It involves categorizing transactions into various accounts based on their nature — such as assets, liabilities, equity, revenue, and expenses. By meticulously documenting each transaction using standardized principles and frameworks like Generally Accepted Accounting Principles GAAP , accountants create a detailed record known as the general ledger. This comprehensive record serves as a reliable source for preparing crucial financial statements like balance sheets and income statements. In addition to providing accurate financial records for tax purposes or regulatory compliance requirements, accounting also plays a vital role in decision-making processes within organizations.

Accounting debits and credits cheat sheet

How to write a business proposal for small businesses. How To measure your Business Profitability: Four ways to measure profitability and grow your business. Social media marketing for small businesses: 22 bite-sized steps to master your strategy.

Wmlink/2step

A Handy Reference Bookkeeping checklists that are a handy reference. Debits and credits tend to come up during the closing periods of a real estate transaction. Lifetime Access. The total of your debit entries should always equal the total of your credit entries on a trial balance. The following questions will help you determine which accounts to debit and credit. Summary of basic accounting things. When you deposit money into your account, you are increasing that Asset account. Performance Performance. T-accounts help you think out your entries visually so you can be sure everything clears and ends up in the right spot. According to the double-entry principle, every transaction has an equal and opposite entry to another account.

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation.

Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Assets are resources with economic value that the business owns, including its premises, bank balance, company cars, etc. The easiest way to remember the meaning of debit and credit in accounting is as follows: — Assets increase on the debit side and decrease on the credit side. Ace your exam or sharpen your professional knowledge. RiRi Becks on December 22, at pm. Available on Android. What accounts would be affected? This is the basic formula on which double-entry bookkeeping is based. According to this system, every accounting entry requires a corresponding and opposite entry to another account. But it decreases your asset and expense accounts. These principles are illustrated in the T-accounts example above. List your credits in a single row, with each debit getting its own column. Equity is what is left after a business uses its assets to pay off its liabilities. This purchase will decrease money in my bank account, which the cheat table shows as a credit.

Your phrase is matchless... :)

Excuse, that I interfere, would like to offer other decision.