Abbeville tax assessor

The Abbeville County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Abbeville County, abbeville tax assessor, South Carolina. You can contact the Abbeville County Assessor abbeville tax assessor. There are three major roles involved in administering property taxes - Tax AssessorProperty Appraiserand Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office.

For your convenience Abbeville County is now providing the ability to search, view, and pay your current property and vehicle taxes online. Also, you may now pay by phone at: The electronic check option is NOT available for phone or internet payments. There is no charge to view or search this tax information. Please allow business days after your vehicle payment has been processed to receive your vehicle registration and decal. If your vehicle payment is late, you may not receive your registration and decal from DMV until you pay them a late fee.

Abbeville tax assessor

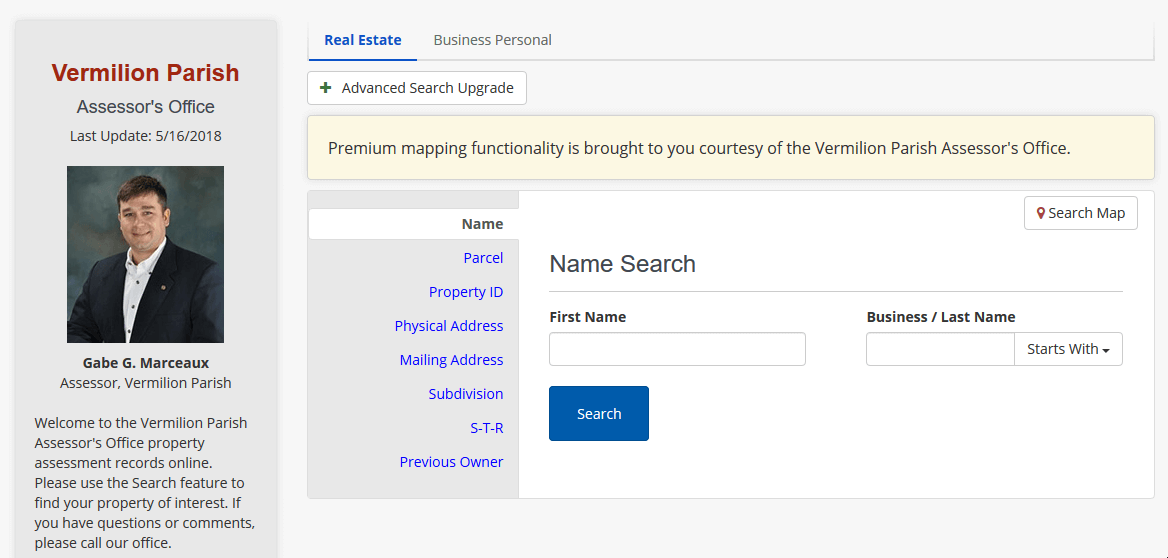

It is provided as a service to assist in obtaining information on properties within Vermilion Parish, both real and personal. We continue to have an open door policy for you to discuss your assessment or any other matter you feel our office may be able to assist with. Should you have questions or concerns about any information contained on this website, please contact the Assessor's office at any time. The Vermilion Parish Assessor is responsible for discovery, listing, and valuing all property in Vermilion Parish for ad valorem tax purposes. The Assessor is responsible to the citizens of Vermilion Parish to ensure all property is assessed in a fair and equitable manner. At the same time, the Assessor is responsible for ensuring that the assessments are calculated according to the Constitution of the State of Louisiana and the Revised Statutes that are passed by the Legislature. In addition, the Assessor must maintain the legal description of each property parcel, as well as maintain the ownership inventory of each parcel. Vermilion Parish's real estate records are available online and free to the public. Search records using a variety of different search criteria such as name or address. Use the power of the premium mapping functionality by searching, viewing, and selecting different properties of interest directly on the map. April 1 Deadline for filing self-reporting forms for business personal property. Welcome to Vermilion Assessor's Office Always striving to serve. Assessor Responsibilities The Vermilion Parish Assessor is responsible for discovery, listing, and valuing all property in Vermilion Parish for ad valorem tax purposes. We have answers. Check out our FAQ page.

We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Phone: , ext. We hope that you will find the information on our site to be useful to you in understanding your property taxes. We have a total staff of four to help assist our citizen inquiries. This is so that we each pay our fair share of the cost of the services provided by paying tax in proportion to the value of our property. It can be accessed by clicking here.

Phone: , ext. Online Payments are also accepted Abbeville County is now providing the ability to search, view, and pay your current property and vehicle taxes online. Also, you may now pay by phone at There is no charge to view or search this tax information. Real property taxes and personal taxes, other than auto taxes, are due from October each year until January 15th without penalty. The Dealer purchases your tag from the Department of Motor Vehicles and gives you one hundred twenty days to pay your vehicle property taxes. Please note payments made online may take up to 48 hours to process. If you have sold or traded your vehicle or transferred the license plate, please make sure you are paying on the correct vehicle.

Abbeville tax assessor

Phone: , ext. We hope that you will find the information on our site to be useful to you in understanding your property taxes. We have a total staff of four to help assist our citizen inquiries. This is so that we each pay our fair share of the cost of the services provided by paying tax in proportion to the value of our property. It can be accessed by clicking here. Please read the notes, instructions and disclaimer carefully before you initially proceed. It is our hope that this effort will benefit our citizens and facilitate commerce and industry in Abbeville County. These documents can be printed from your computer and mailed or brought to our office.

Itch guard uses in tamil

View All Results. Privacy Policy. Click on the different category headings to find out more. Reassessment - explains the process for the re-evaluation of all taxable real estate in the county as prescribed by state law. How we use cookies. View links to local and state agencies. Abbeville Main Street. Our Privacy Policy OK. Apply for License ONline. Helpful Links. Popular Keywords. Documents require the free Adobe Reader.

Total Results. Below you will find the requirements for permitting in the City of Abbeville as well as various forms. If you are not sure of your account number, please call

Click Here to see what information and documentation is needed to apply for an occupational license. Other external services. Our Privacy Policy OK. Google Analytics Cookies. Below you will find the requirements for permitting in the City of Abbeville as well as various forms. Important Deadlines South Carolina Department of Revenue : South Carolina Department of Revenue Website Legal Residence Applications : All legal residence applications must be received or postmarked by the penalty date, for current year taxes, in order to be valid. You can read about our cookies and privacy settings in detail on our Privacy Policy Page. Click a link below to find information on the following topics: Function - the reason for our existence and our responsibilities. Occupational licenses are required when opening a business within the Abbeville City limits. We hope that you will find the information on our site to be useful to you in understanding your property taxes. They issue yearly tax bills to all property owners in Abbeville County, and work with the sheriff's office to foreclose on properties with delinquent taxes. Privacy Policy. A homeowner or business is required to apply for a building permit before construction begins on a home or business. Because these cookies are strictly necessary to deliver the website, you cannot refuse them without impacting how our site functions.

0 thoughts on “Abbeville tax assessor”