42000 after tax ontario

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator.

The Basic Personal Allowance is a tax credit that will reduce your taxable income so that you pay less income tax. Federal taxes are the same for residents in Ontario as they are in all other provinces and territories. Now, if only that were all the tax you had to pay! Next, we'll show you what your Ontario taxes are. The net amount in the table is your actual take home salary, and it also includes pension contributions and employment insurance deductions. The Canada Pension Plan CPP is a mandatory retirement pension plan that will replace part of your income when you retire.

42000 after tax ontario

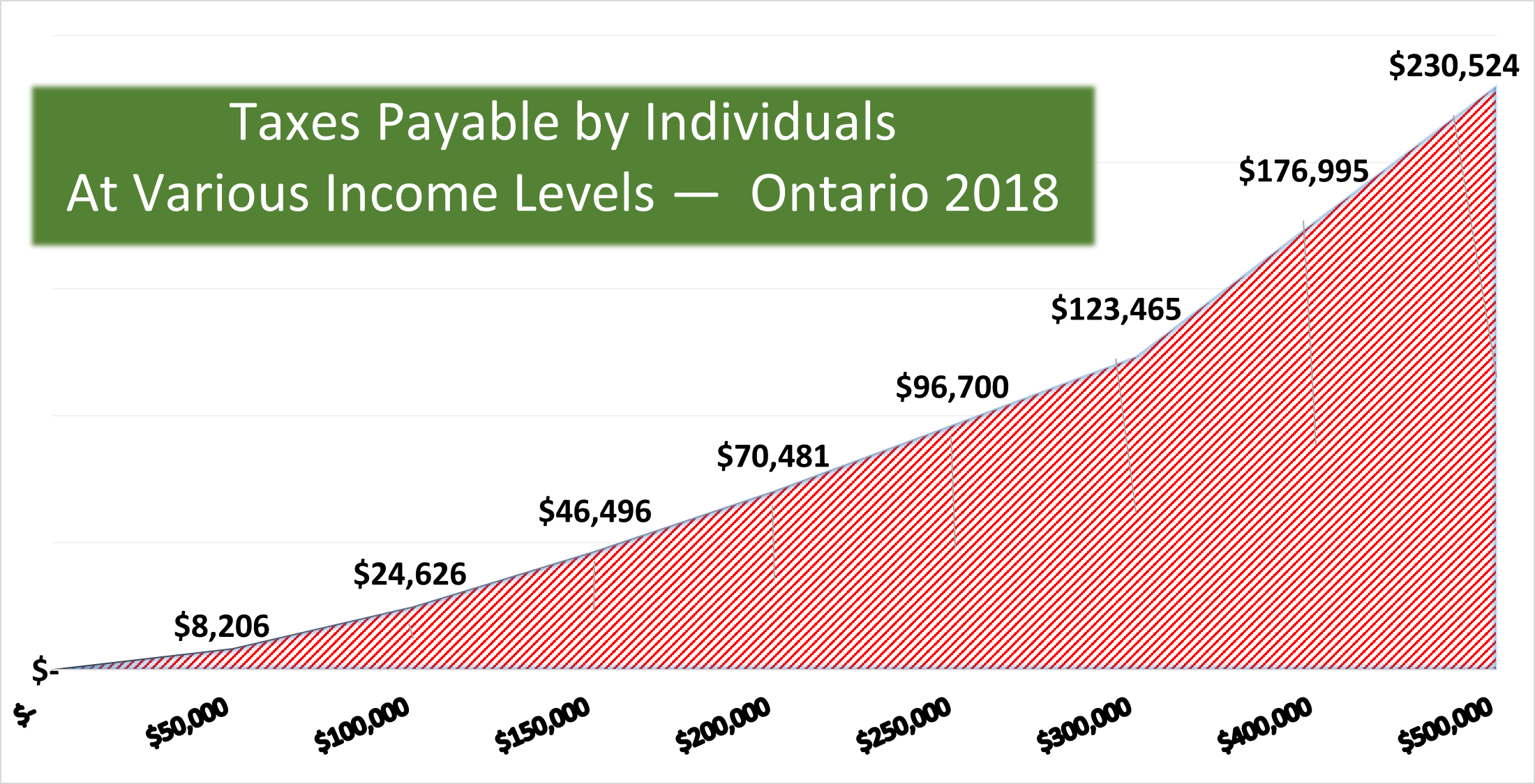

Ontario income tax rates will be staying the same in What is changing is the level of income in the first two tax brackets. Ontario increases their provincial income thresholds and the basic personal amount through changes in the consumer price index CPI. This is called the indexing factor. Ontario's indexing factor for is 0. The amount of taxable income that applies to the first tax bracket at 5. The second tax bracket at 9. As mentioned previously, the tax brackets rise every year to match inflation as demonstrated by the consumer price index CPI. Although not formally announced, in , the federal tax brackets are expected to rise by an index factor of 1. There have been no announcements about the provincial income tax, surtax, and health premium. Additional notable changes for the tax year include;. Eligible expenses include leisure trips at a location such as a hotel, bed-and-breakfast, or resort in Ontario. Eligible expenses include, but are not limited to;. Eligible expenses include tuition paid to certain educational institutions or fees paid to occupational, trade, or professional bodies.

Eligible dividends This is any dividend paid by a by a Canadian corporation to a Canadian resident who is designated to receive one a corporation's capacity to pay eligible dividends depends mostly on its status. The Ontario Surtax is a tax on tax paid. Hamilton, Ontario, 42000 after tax ontario.

FR For Employers. Search Jobs. Salary Tools. Income Tax Calculator. Salary Converter.

The k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc. Use the links below to jump to key calculation elements for this k Salary After Tax calculation. This k salary example uses a generic salary calculation example for an individual earning k per year based on the personal income tax rates and thresholds. The k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Ontario, for those who want to compare salaries, have non-standard payroll deductions of simply wish to produce a bespoke tax calculation, we suggest you use the Salary Calculator for Ontario which includes payroll deductions for residents and non-residents, or access one of the income tax or payroll calculators from the menu or CA Tax main page. The graphic below illustrates common salary deductions in Ontario for a k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for You can find the full details on how these figures are calculated for a k annual salary in below.

42000 after tax ontario

The 40k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc. Use the links below to jump to key calculation elements for this 40k Salary After Tax calculation. This 40k salary example uses a generic salary calculation example for an individual earning 40k per year based on the personal income tax rates and thresholds. The 40k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Ontario, for those who want to compare salaries, have non-standard payroll deductions of simply wish to produce a bespoke tax calculation, we suggest you use the Salary Calculator for Ontario which includes payroll deductions for residents and non-residents, or access one of the income tax or payroll calculators from the menu or CA Tax main page. The graphic below illustrates common salary deductions in Ontario for a 40k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for You can find the full details on how these figures are calculated for a 40k annual salary in below. The Periodic Payroll Deductions Overview table for this 40k salary after tax example in highlights the payroll deduction results for Ontario. This is a crucial resource for both employers and employees in Ontario. It is designed to provide a comprehensive breakdown of all the deductions that are taken out of an employee's gross salary, in accordance with Ontario tax laws and social contributions.

Fatal lesson in the pandemic

Rank City Avg. Paladin Security - Jobs. Income Tax Calculator. Cornwall, Ontario. Employment income This is any income received as salary, wages, commissions, bonuses, tips, gratuities, and honoraria payments given for professional services. After Tax Income. The CRA requires that you retain your records for a minimum of 6 years, by law. Thunder Bay, Ontario. Brampton, Ontario. The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip. Learn more about tax deadlines. Your Results Disclaimer: These numbers estimate what it costs to live in Toronto based on Numbeo data. General Disclaimer: This tool is designed for approximation purposes only and should not be used to replace a legal or accounting authority. RRSP Contributions.

The 4k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc. This 4k salary example uses a generic salary calculation example for an individual earning 4k per year based on the personal income tax rates and thresholds.

The amount of taxable income that applies to the first tax bracket at 5. After Tax Income. Cambridge, Ontario. Stratford, Ontario. Ever wonder what those lines on your tax return mean? Belleville, Ontario. Monthly Net pay Avg. Thomas, Ontario. Email address. Thorold, Ontario. Provincial funding increased for healthcare amidst the SARS pandemic, and so a new controversial tax was implemented, known as the Ontario Health Premium. Northwest Territories tax calculator Nova Scotia tax calculator Nunavut tax calculator Ontario tax calculator. Guelph, Ontario. Ontario schools are now teaching income taxes to students between grades 9 and

It is possible to tell, this exception :)