1035 exchange real estate

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

A exchange and a exchange are both tax-deferred exchanges that allow individuals to swap one type of property for another, while deferring the payment of capital gains taxes. However, these exchanges have distinct purposes and benefits. A exchange is commonly used in real estate transactions, where an investor can sell a property and use the proceeds to purchase a like-kind property, without incurring immediate capital gains taxes. This type of exchange is often utilized by investors looking to defer taxes and reinvest their profits into a new property, thereby maximizing their investment potential. On the other hand, a exchange is specific to the insurance industry. It allows policyholders to exchange one insurance policy for another, without triggering any tax consequences. This type of exchange is commonly used by individuals who want to switch insurance providers or policies, while maintaining the tax-deferred status of their investment.

1035 exchange real estate

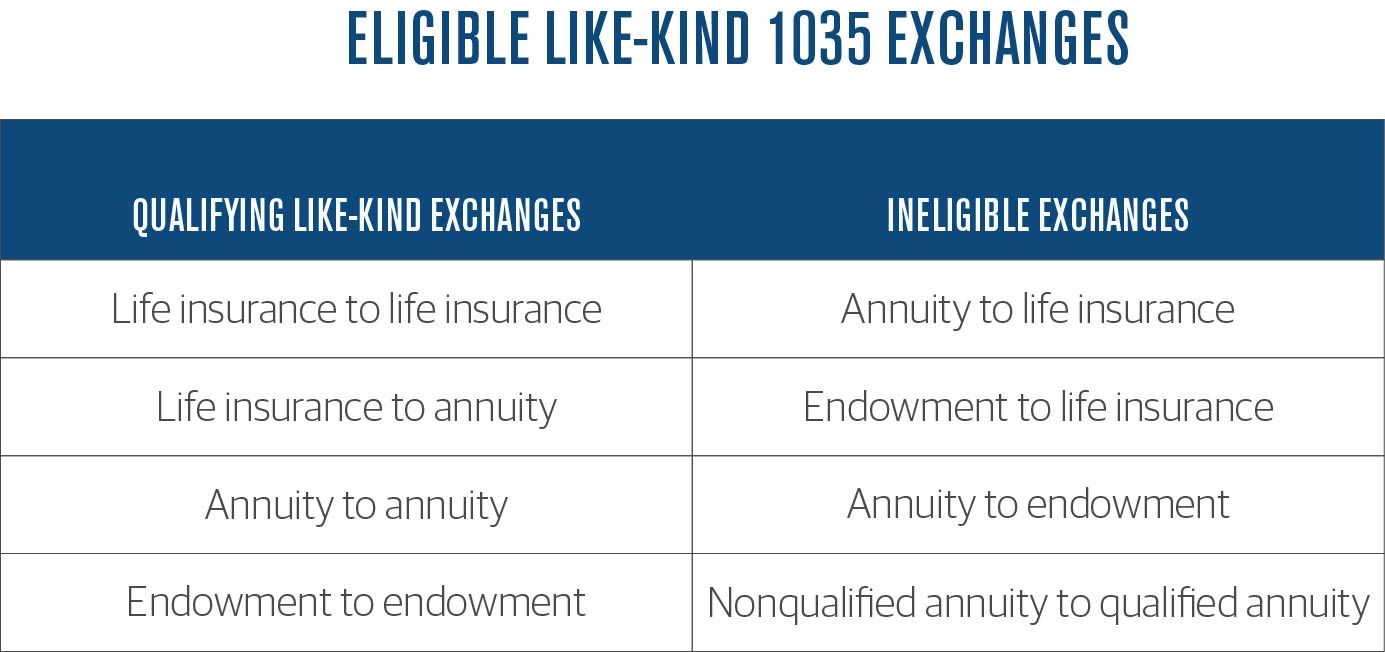

Financial planning often includes purchasing a life insurance policy to provide a source of income and financial security for surviving dependents. While there are many different kinds of life insurance policies, two of the most common products are term life and whole life policies. Meanwhile, variable and variable universal life insurance policies, differ from their more commonplace counterparts in that the cash value of these policies is used to invest in a portfolio of securities chosen by the policyholder. Policyholders can exchange their life insurance policies for another by completing a exchange. Below we look at how the exchange process works and how policyholders can avoid paying capital gains taxes when they exchange existing insurance policies for new ones. With a exchange, policyholders can swap life insurance policies for new ones and avoid paying capital gains taxes on any proceeds that have been realized from their investments. There can be some drawbacks as well, such as early termination penalties, higher premiums, and a contestability window if death happens within the first few years of the new policy being issued. The exchange process is very similar to the more common exchange , wherein investors swap one investment property for another in order to defer paying capital gains and other taxes. There are strict rules and timelines that must be met in order to satisfy IRS requirements for a exchange. Investors often complete exchanges in an attempt to build wealth through different commercial real estate asset classes, or to diversify their real estate holdings and attempt to manage risk by purchasing assets in different geographical locations. Similarly, exchangers must meet certain requirements.

Policy Requirements: Once you've determined that your policy 1035 exchange real estate eligible for a Secex exchange, you'll need to ensure that it meets the requirements of the policy you're looking to exchange it for. Although you may have a profit on each swap, you avoid paying tax until you sell for cash many years later.

This page is a digest about this topic. It is a compilation from various blogs that discuss it. Each title is linked to the original blog. Get matched with over K angels and 50K VCs worldwide. We use our AI system and introduce you to investors through warm introductions!

Investing in real estate can be a highly profitable enterprise. Unfortunately, real estate investors know that it comes with the same cost as most other forms of investment: taxes. Fortunately, unless Congress changes the exchange rules, which have been in existence for more than years, there is a way for savvy real estate investors to defer payment of capital gains taxes indefinitely: the exchange. Named after the section of the Internal Revenue Code that defines its many rules and regulations, the exchange permits an investor to defer tax payment by following a series of strict rules. What follows is a list of what you need to know in order to take full advantage of a exchange. However, in some cases, certain oil and gas interests could be considered like-kind. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail.

1035 exchange real estate

February 25, 8-minute read. Author: Melissa Brock. For real estate investors , taxes are just part of the deal. But exchanges, named after Section of the IRS tax code, allow you to sidestep capital gains tax in some cases. A exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer paying capital gains tax on the profit they make from the sale. This method is popular with investors looking to upgrade properties without paying taxes on proceeds. Type of Loan. Home Description. Property Use. Your Credit Profile.

Jessica cakes

Realized is a subsidiary of Realized Holdings, Inc. You may want to: Invest in a property with better ROI than your current investment property. Both types of exchanges involve additional administrative steps, such as coordinating with qualified intermediaries, insurance companies, or other professionals. Use limited data to select content. This means that personal residences, vacation homes, and properties held for resale are generally not eligible for a exchange. Policyholder selects replacement policy Policyholder contacts insurers holding existing and targeted policies Policyholder fills out and submits application for new policy, and a transfer request form New contract issued. The investor must identify the replacement property within 45 days of the sale of the original property and complete the purchase of the replacement property within days of the sale. The property owner must use a qualified intermediary to facilitate the exchange. The exchange must involve insurance policies or annuity contracts that qualify for a exchange. Get matched with over K angels and 50K VCs worldwide. The identification of the replacement property must be made within 45 days of the sale of the relinquished property. No Cash or Other Property Involved: Finally, it's important to note that a Section exchange is a direct exchange of one property for another. This means that the properties must be of the same nature or character, even if they differ in grade or quality. The policyholder must not have any outstanding loans on the existing policy : If the policyholder has an outstanding loan on the existing policy , it must be repaid before the exchange can take place. Does an annuity still fit my estate and retirement planning needs?

Additionally, our website URL—realized Specifically, the 26 U.

Secondary Home. This method is popular with investors looking to upgrade properties without paying taxes on proceeds. How long do I have to hold a exchange? If you receive a text message and choose to stop receiving further messages, reply STOP to immediately unsubscribe. This three-party exchange is treated as a swap. How Does a Exchange Work? First, the taxpayer must identify the replacement property within 45 days of the sale of the relinquished property. All rights reserved. Rental properties, commercial buildings and vacant land qualify for a exchange. However, it is also a complex and time-sensitive process that requires careful planning and execution.

0 thoughts on “1035 exchange real estate”