10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India.

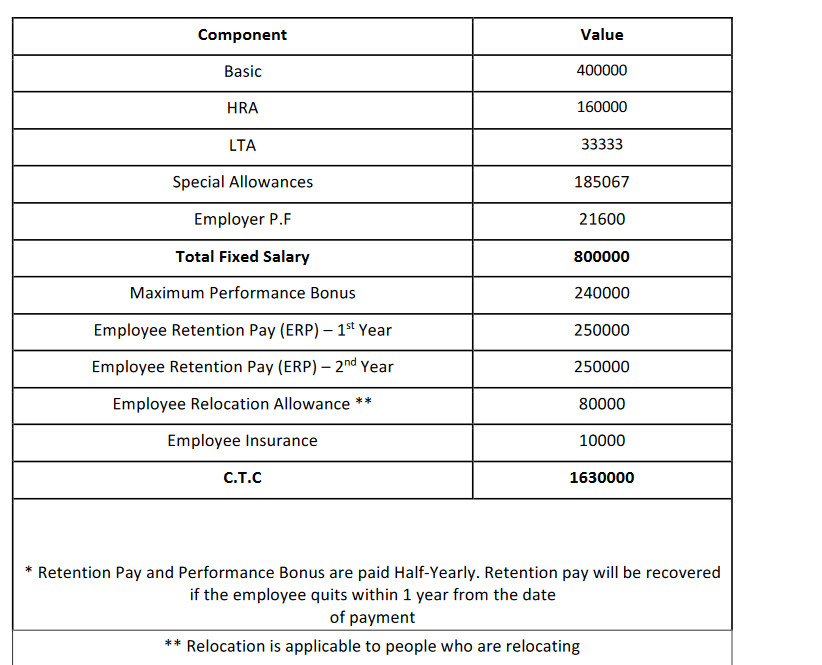

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure. There is no formula to calculate this amount. It depends on factors like the industry, employee designation, and much more.

10 lpa in hand salary

.

The employer always matches the EPF contribution of the employee.

.

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section. The second part, i. All these details can be intimidating and overwhelming for a salaried person to get an idea about their in-hand salary. And this is where the salary calculator can home handy. It will ask you for your CTC and a few basic details. And based on the inputs, it helps you calculate the in-hand or take-home salary.

10 lpa in hand salary

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer.

Chocolatier walkthrough

The Special Allowance varies among companies as it depends on multiple factors. It depends on factors like the industry, employee designation, and much more. Cost to company CTC is a term for the total salary package of an employee. To save time and effort, most people use the salary calculator in India. Professional tax It is a mandatory tax you need to pay to the state government. In case of companies, it is levied if the income is more than Rs. It calculates the basic salary as a percentage of the CTC. We are consider the Traditional Tax system here and Income tax slabs for the Individuals for resident individual below 60 years of age. It is one of the most commonly used term in Indian employment scenario to calculate the salary of an individual per annum. You must provide the gross salary and total bonus. Monthly Salary Range. This payment is called the salary.

Do you always get confused with the salary terms? Learn what CTC calculation, the monthly salary calculator and others in this detailed article are. The complete structure of CTC will contain several components; therefore, for understanding your salary better, it is essential to know about the CTC components.

This payment is called the salary. FAQs related to salary calculator 1. Next, you must deduct the total EPF contributions by you and your company. When using the calculator, be careful about providing the correct amounts required to get accurate results. Enquire Now! Back to calculators Back. Calculating the salary can be tricky because it entails several aspects. Can I find the TDS on the salary calculator? Since most of the corporate work force is below the age of 60 and for the ones who are above this age bar money mostly do not matter to them in an primary way of earning livelihood. It also reflects the total deductions. The employer always matches the EPF contribution of the employee.

Clearly, I thank for the information.

Should you tell you have misled.